Don't listen to arthur laffer, california's gonna be fine

Arthur Laffer has a new piece of anti-tax propaganda out called So Long, California. Sayonara New York and, consistent with Laffer’s modus operandi, it’s a real festival of non-evidence-based pontification.

The Claims

A. Relatively high state and local taxes drive migration - people, on balance, leave high tax states and move to low tax states.

B. Net migration is bad for state budgets.

It is important to note that in order for Laffer’s prescription

As far as we can see, the only way for blue states to prevent this coming fiscal bloodbath is to start taking tax competitiveness seriously—and to cut their tax rates in response. Progressives should do the math: A 13% tax rate generates zero revenue from someone who leaves the state for friendlier climes.

to be valuable/accurate/not stupid, both claims A and B must be simultaneously true.

That is, it must be the case that:

- People are leaving California BECAUSE of the high tax structure, and

- Rich people are leaving at higher rates than poor people

The Evidence

The authors offer, as evidence of point A, the fact that since 2007 California and New York have lost more than 2.2 million residents. I don’t dispute this fact…but saying that people left isn’t the same as saying that people left BECAUSE state and local taxes were too high.

Evaluating The Evidence

As I alluded to in The Claims section, when thinking about migration out of a state, who stays and who leaves matters. From a state budgeting point-of-view we can think of the state as comprised of two types of people:

- those that pay more in taxes than they extract in services (relatively rich people)

- those that use more services than they pay for in taxes (presumably, poorer people)

If all 2.2 million people who left CA/NY from 2007 - present were the takers then we wouldn’t expect the state to be at particularly high risk of financial collapse. Here is probably where the entire discussion should end because Laffer doesn’t really provide any evidence that the observed out-migration was dominated by rich people. Absent that, there isn’t a very compelling reason to believe that the observed historical out-migration, even if it does accelerate, will make California and New York financially destitute.

So, technically, I could stop here…but I won’t. Even if we assume (absent any supporting evidence) that the people leaving California are all high income individuals, we are still left with the task of establishing a causal link between out-migration of rich people and tax burden.

Do high taxes drive out-migration of rich people?

Some academic evidence

Young and Varner, 2011 find little to no outmigration of high income individuals in response to a ‘millionaire’s tax’. This study leveraged the difference-in-differences methodology to test whether millionaires left New Jersey following the implementation of a ‘millionaire’s tax’ at higher rates than they relocated from other states. The evidence suggests they did not.

In a follow-up analysis Young, Varner, Lurie, and Prisinzano, 2016 find:

We find that millionaire tax flight is occurring, but only at the margins of statistical and socioeconomic significance.

Some empirical evidence

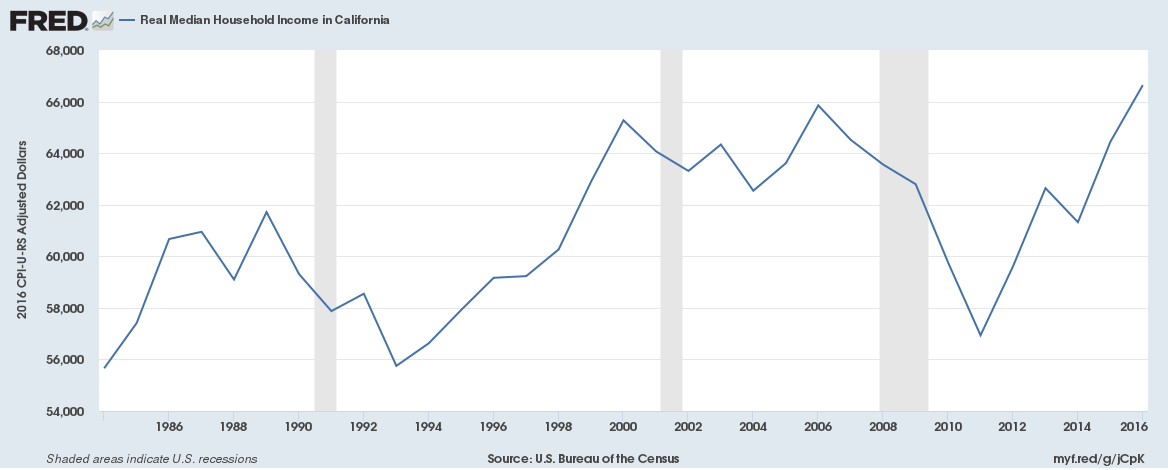

If high state and local taxes were causing large scale tax-flight among high earners we should see this reflected in the changes in distribution of income. Put simply, if all the rich people are leaving California because high taxes then the median per capita income should be going down. It’s not. California has been a high tax state since at least the 1990s.

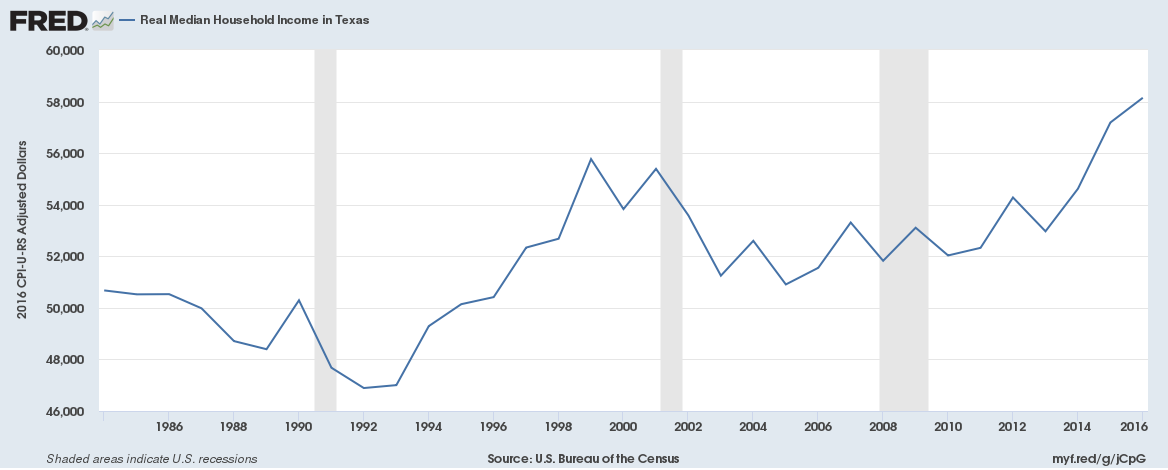

California did experience a notable decline in real household income from 2008 - 2011 when the housing market crashed. But from 2011 - 2016 median household income in California grew faster (3%/year) than it did in Texas (2%/year). Once again, if Laffer’s assumptions are right and all the rich people left California because of high taxes and moved to Texas, then we should have seen California’s median household income drop…and we should have seen Texas’s median household income rise faster than high tax states.

So why does this bother me?

Here’s a question I get often from my friends who are not engaged in science-based pursuits. Why do you care if some dude wrote an Op-Ed that’s really wrong? I care because Arthur Laffer is supposed to be a Social Scientist and Scientists are supposed to craft arguments carefully. And this shit isn’t careful, it’s sloppy.

When the Wall Street Journal publishes an Opinion it does so with the expectation that the author should be afforded some deference because of expertise on the topic at hand. If my 4-year old daughter developed strong opinions about the price dynamics of the Bay Area housing market, I doubt the Wall Street Journal would be beating down our door to publish them. So when Arthur Laffer publishes an Op-Ed on taxation and migration, it’s not appropriate to write it off as, “just some dude’s opinion.” So when said dude publishes a sloppy, poorly sourced argument for lower state and location taxes, it pisses me off.

Here is an example of what I’m talking about: In the Op-Ed, Laffer fails to provide convincing evidence that tax burden drives high income individuals out of high tax states. He does however, reference a report called Rich State Poor State. If one were being charitable, one would assume that, perhaps, in this report there is some infallable evidence for the tax flight hypothesis. Spoiler alert: I read the report and there is not.

In an Appendix to the 11th Edition of Rich State Poor State, it does say something to the effect of

In previous editions we discussed the inclusion of 15 variables that have been shown to have a measurable impact on migration.

Among these 15 variables are various different kinds of state and local taxes.

I would generally be ok with this argument, basically they are saying, “we can’t really get into the technical details in an Op-Ed but we did demonstrate the causal link between taxation and migration of high income earners in this study that you can look at.”

The thing is, they didn’t. Here is the incredibly circular chain of evidence as I have been able to unravel it:

- In the 11th Edition of Rich State Poor State, they say that, “in previous version we discuss the tax variables.”

- In the 9th Edition of Rich State Poor State, they again say something like, “trust us, there is a well-known relationship between tax burden and migration.

- In a really early edition, they cite, not a peer reviewed, scientific study linking tax burden to migration but an American Legislative Exchange Council report on taxation.

Surprisingly, I had not herd of the American Legislative Exchange Council until I read this Op-Ed. Apparently, they are about as scientifically minded as the Answers in Genesis Project. I guess what I’m saying is, if some researchers had found, through careful study of available data, a causal link between local taxation and migration, it would definitely be published in the peer reviewed literature….not as part of some dubious white-paper series from a propoganda organization.

Summary

Evidence for tax flight

- Arthur Laffer says so

Evidence for no tax flight

- Young and Varner (2011) a rigorous cross-state difference-in-differences study

- Young et al. (2016) a rigorous 13 year study of millionaires’ tax returns

- Median household income in California going up not down - if all the rich people are leaving then median household income should be going down.

Just to be clear, I’m not saying tax flight isn’t a real thing. I’m not claiming to have rigorously tested the tax flight hypothesis. However, Arthur Laffer and the Wall Street Journal ARE claiming that:

- tax flight is real

- it’s going to get worse

- California is going broke unless they lower state and local taxes

And what’s truly amazing (but I guess not really that amazing if you’re familar with Art Laffer’s economic hallucinations) is that Laffer and the WSJ are making these dire economic prognotications in the complete absence of any reputable supporting empirical evidence for their position.

A Bigger Point

Laffer (and a bunch of other kooky supply side zealots) were fabulously wrong about the inflationary ramifications of the Fed’s policy of Quantitative Easing. In 2009 Laffer wrote a screed in the Wall Street Journal asserting that the Federal Reserve’s policy of Quantitative Easing was sure to precipitate price inflation that would “make the 70’s look benign” and should be immediately discontinued.

To Laffer’s credit he was reasonably open about being wrong

Usually when you find the model this far off, you’ve probably got something wrong with the model, not that the world has changed,” he said. “Inflation does not appear to be monetary base driven

I don’t fault anyone for being wrong. That’s part of science. We develop predictions based on our current understanding of economic systems, we test those predictions by fitting data to models, then (if we are half decent Bayesians) we update our understanding of the system based on the results of model fitting.

There are a few reasons that models can produce incorrect predictions:

- there are unobservable forces acting on system dynamics

- data limitations - maybe we have a small non-representative sample from which we are trying to extrapolate population behaviors

- some fundamental assumptions of the model are wrong

My main beef with Laffer and some of the dudes he runs with isn’t that they get shit wrong. It’s that they don’t seem to have the appropriate respect for the process of developing theory. To me good theory that really holds water comes from:

- use intuition to form a hypothesis

- use math to craft the intuition into an empirically testable (set of) hypotheses

- use data to test those hypotheses

- refine models accordingly

My personal aversion to some of the macro guys like Art Laffer is that they like to draw shit out on cocktail napkins that end up in textbooks without any empirical validation.

Some Bonus Reading

Laffer’s original warning about the inevitable currency devaluation that QE was going to bring about partially motivated an pretty famous open letter to Ben Bernanke. There has been a decent amount of discussion among reputable economists about why these claims about the inflationary potential of QE were so wrong. A lot of these discussions involve the poorly understood but often cited “Liquidity Trap.” Full disclosure: I have only a vague understanding of the liquidity trap. Here are some of the discussion threads that I found interesting when I was basking in the warm glow of Arthur Laffer wrong-ness.

Krugman has a decent little blurb on why QE did not cause large-scale currency debasement in the U.S.

Not a super big fan of The Money Illusion but I did like this post on why Quantitative Easing failed to produce the kind of catastrophic inflation many old-skool macro guys predicted.